Introduction to Real Estate Investment Apps

The real estate investment landscape in 2025 is significantly shaped by readily available technology. Investment apps are no longer niche tools but are increasingly sophisticated platforms enabling diverse participation in the market. This evolution is driven by factors like improved accessibility, streamlined processes, and the desire for diversification.

Real estate investment apps cater to a broader range of investors, from seasoned professionals to novice individuals. They offer various investment avenues and management tools, enhancing transparency and reducing barriers to entry for those seeking to leverage real estate as an asset class.

Different Types of Real Estate Investment Apps

Real estate investment apps cater to diverse needs and strategies. They encompass various types, each tailored to specific investor objectives. These include platforms for crowdfunding, property management, brokerage, and others focused on specialized areas like student housing or senior living.

Common Features and Functionalities

Real estate investment apps, irrespective of their specific type, often share core functionalities. These include user-friendly interfaces for navigating the platform, secure transaction management, and comprehensive reporting tools. Many apps also provide educational resources to aid users in making informed decisions.

Comparison of Real Estate Investment App Categories

| Category | Key Features | Target Audience | Example App |

|---|---|---|---|

| Crowdfunding | Facilitates raising capital for real estate projects by pooling small investments from multiple individuals. Typically features detailed project information, investment minimums, and projected returns. | Individuals seeking diversified investments with lower capital requirements, often interested in specific real estate projects or sectors. | RealtyMogul |

| Property Management | Offers tools for managing rental properties, including tenant screening, lease agreements, maintenance requests, and financial reporting. Often integrates with payment processing systems. | Landlords and property owners seeking to streamline their property management operations and gain better control of their investment. | Buildium |

| Brokerage | Provides real estate brokerage services, including property listings, valuations, market analysis, and transaction support. May also incorporate tools for investment analysis. | Individuals or businesses seeking to buy, sell, or lease real estate, potentially including investors wanting to streamline their portfolio management. | Redfin |

| Specialized Investment | Focuses on particular types of real estate investments like student housing, senior living, or industrial properties. Offers detailed information on those niche markets. | Investors interested in specific real estate sectors, often seeking higher returns or a particular demographic focus. | (Hypothetical Example: “Student Housing Investment Network”) |

Evaluating App Functionality

Real estate investment apps are rapidly evolving, offering diverse features for users to navigate the complexities of the market. Assessing their effectiveness hinges on understanding not just the available tools, but also how intuitive and reliable these tools are for users. In 2025, robust functionality is crucial, alongside a user-friendly interface and dependable platform stability.

Modern real estate investment apps need to provide a seamless and informed experience for investors, allowing them to efficiently research properties, manage portfolios, and track performance. This includes everything from property search and analysis tools to portfolio management and reporting features.

Essential Functionalities for a “Working” App

A functional real estate investment app in 2025 must offer a comprehensive suite of tools. These include robust property search capabilities with advanced filters, allowing users to pinpoint properties matching their specific criteria. Accurate market data, real-time updates, and comparative analysis are paramount. Users need access to detailed financial projections and risk assessments to make informed decisions. A crucial aspect is secure transaction management, including escrow services and integration with other financial institutions. Finally, portfolio management tools, including tracking and reporting functions, are vital for monitoring returns and optimizing investments.

Factors Impacting User Experience

User experience (UX) is paramount in the success of any application. Ease of use is critical, with intuitive navigation and a clean design. A well-organized layout and clear explanations minimize user frustration. Platform stability is equally important; frequent crashes or slow performance significantly degrade the user experience. Secure data handling and robust security measures are essential for building trust. Accessibility features for diverse users should be considered.

Comparison of Investment App Platforms, Real Estate Investment Apps That Actually Work in 2025

Different real estate investment app platforms vary significantly in their features and approaches. Some platforms focus on providing a wide range of investment options, while others specialize in specific niches, such as commercial real estate or residential rentals. The level of integration with other financial tools, such as brokerage accounts, can vary considerably. Understanding these differences is crucial for users to choose the platform that best suits their needs and investment strategies.

Pros and Cons of Various Real Estate Investment Apps

| App Name | Pros | Cons | Target Audience |

|---|---|---|---|

| InvestWise | Comprehensive property search, advanced analytics, secure transaction management. | Subscription fees can be high, interface can be complex for beginners. | Experienced investors, sophisticated users |

| PropertyPro | Intuitive interface, user-friendly portfolio management tools, good for beginners. | Limited advanced analytics, potentially less comprehensive market data. | New investors, those prioritizing ease of use. |

| RealtyConnect | Excellent integration with brokerage accounts, fast transaction processing. | Can be expensive for frequent transactions, limited property search features. | Investors needing tight integration with existing accounts. |

| LandLord | Focuses on residential rentals, detailed reporting on rental income. | Limited investment options outside rentals, less sophisticated analytics. | Individuals and small businesses focusing on rental income. |

Analyzing Investment Opportunities

Real estate investment apps are rapidly evolving, offering diverse opportunities for investors in 2025. These platforms streamline the process, allowing access to a broader range of properties and investment strategies. Navigating these opportunities requires a clear understanding of the potential returns, associated risks, and due diligence procedures.

Investment Opportunity Identification

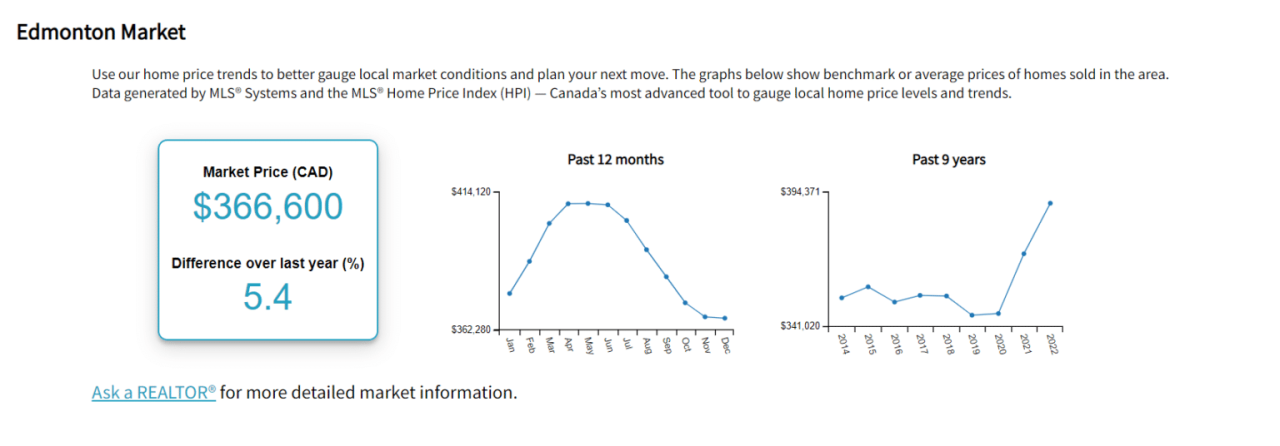

Real estate investment apps leverage data analytics and market research to pinpoint promising investment opportunities. They often filter properties based on user-defined criteria, such as location, property type, and price range. Advanced algorithms can also assess potential rental income and occupancy rates, aiding in informed decision-making.

Examples of Investment Opportunities

Numerous real estate investment apps offer diverse investment opportunities. For instance, some apps might feature single-family homes for purchase, with the potential for long-term capital appreciation. Others might focus on multi-family properties, offering steady rental income streams. Some platforms specialize in commercial properties, presenting the possibility of higher returns but also increased risk. Further, some platforms facilitate fractional ownership, enabling investors to participate in larger, more complex projects.

Risks Associated with Real Estate Investment Apps

While real estate investment apps provide convenience, inherent risks exist. The accuracy of the data presented, especially regarding market projections, can vary. Fraudulent listings or misrepresented property conditions are potential pitfalls. Furthermore, unexpected market fluctuations or changes in local regulations can negatively impact returns. Investors must always assess the risks associated with any investment.

Due Diligence Process

Thorough due diligence is crucial before committing to any real estate investment through an app. Investors should independently verify property details, including legal documents and property valuations. Local market research is essential to evaluate the property’s potential and current rental market conditions. It is also critical to evaluate the app’s reputation and track record. Consulting with a qualified real estate professional is highly recommended.

Comparative Analysis of Investment Opportunities

| App Name | Opportunity Type | Estimated Return (Annualized) | Risk Assessment |

|---|---|---|---|

| App A | Single-family home purchase | 4-6% | Moderate risk, primarily related to market fluctuations and property maintenance |

| App B | Multi-family property investment | 7-9% | Moderate to high risk, depending on property condition and market stability |

| App C | Commercial property investment | 10-15% | High risk, requiring extensive due diligence and market knowledge |

| App D | Fractional ownership in a mixed-use project | 5-8% | Moderate risk, subject to project timelines and market conditions |

Note: Estimated returns are approximations and can vary based on individual circumstances and market conditions. Risk assessments are general guidelines and do not constitute financial advice.

Security and Trustworthiness of Real Estate Investment Apps

Navigating the world of real estate investment apps requires a keen eye for trustworthiness and robust security measures. The potential for significant financial gains is often balanced against the risk of fraud and data breaches. Understanding the security protocols employed by different platforms is crucial for making informed investment decisions.

Security Measures Offered by Real Estate Investment Platforms

Real estate investment apps employ various security measures to protect user data and transactions. These measures typically include encryption of sensitive information, secure payment gateways, and multi-factor authentication. Strong encryption protocols, like TLS/SSL, safeguard data during transmission. Reputable platforms utilize industry-standard encryption to protect user login credentials, financial details, and other sensitive information.

Importance of User Verification and Data Protection

Thorough user verification is paramount to mitigating fraud risks. Robust verification processes often involve verifying user identities through government-issued documents and background checks. Data protection protocols are equally critical. These include policies regarding data storage, access controls, and regular security audits to prevent unauthorized access or breaches. User data should be stored securely and access should be limited to authorized personnel.

Examples of Fraudulent Real Estate Investment Apps

Several fraudulent real estate investment apps have emerged in recent years. These platforms often promise unrealistic returns, employ misleading marketing tactics, and lack transparency in their operations. One common tactic involves manipulating transaction details to conceal their actual fraudulent practices. Many fraudulent apps prey on the desire for quick and easy wealth accumulation. Users need to be vigilant and critically assess the legitimacy of any investment opportunity, especially those that appear too good to be true. They should thoroughly investigate the company’s history and reputation before committing to any investment.

Best Practices for Identifying Trustworthy Real Estate Investment Apps

Identifying trustworthy real estate investment apps requires a proactive approach. Researching the platform’s reputation and history is essential. Checking for regulatory compliance and licensing is also crucial. Scrutinizing user reviews and testimonials, while not definitive, can provide valuable insights. Reviewing the app’s privacy policy and terms of service can offer clues about data handling practices. Ultimately, a comprehensive assessment of the platform’s security protocols, transparency, and regulatory compliance is vital.

Table of Security Features of Different Real Estate Investment Apps

| App Name | Security Features | User Verification | Data Protection |

|---|---|---|---|

| App A | TLS/SSL encryption, multi-factor authentication, secure payment gateways | Government-issued ID verification, background checks | Data encryption at rest and in transit, regular security audits |

| App B | Secure servers, encryption protocols | Identity verification through multiple sources | Data anonymization, access control lists |

| App C | 2FA, secure login protocols | Verification through social media profiles | Data deletion policies, data breach response plan |

User Experience and Accessibility

Real estate investment apps are increasingly crucial for navigating the complex landscape of property investments. A seamless and intuitive user experience is paramount to attracting and retaining users. A well-designed app fosters trust and encourages continued engagement with the platform.

Modern real estate investment apps need to be more than just functional tools. They must be user-friendly, accessible to a wide range of users, and provide robust support to ensure a positive experience. This includes intuitive navigation, clear information presentation, and readily available assistance for users encountering difficulties.

User Interface and User Experience Design Principles

Effective real estate investment apps prioritize user-centered design principles. A clean and uncluttered interface with clear visual cues significantly enhances the user experience. Visual hierarchy, employing varying font sizes and colors to guide users’ attention to critical information, is crucial. Intuitive navigation, with clear labeling and logical organization of menus and features, minimizes user frustration. Accessibility features like adjustable text sizes and high contrast modes cater to diverse needs and preferences.

Mobile App Accessibility for Diverse Users

Real estate investment apps must be accessible to a wide range of users, including those with disabilities. Adherence to accessibility guidelines, such as WCAG (Web Content Accessibility Guidelines), ensures that users with visual impairments, hearing impairments, or motor disabilities can utilize the app effectively. This includes providing alternative text descriptions for images, captions for videos, and keyboard navigation options. Features like screen readers, voice commands, and adjustable font sizes are vital. Furthermore, the apps should consider diverse cultural contexts and language support.

Importance of User Support in Real Estate Investment Apps

Effective user support is critical to maintaining user satisfaction and resolving issues promptly. Investment apps should provide comprehensive FAQs, tutorials, and video demonstrations to guide users through various features. A robust customer support system, with responsive email, phone, or live chat options, is crucial. Immediate assistance for common issues and personalized guidance for more complex queries ensures a positive user experience.

Examples of User-Friendly Real Estate Investment App Designs

Several apps excel in providing a positive user experience. Examples include intuitive navigation structures, clear visualization of investment data, and easy-to-understand financial reports. A well-structured layout, clear categorization of investment properties, and user-friendly filters contribute to a seamless experience. The apps’ interfaces prioritize visual clarity and simplicity, allowing users to quickly understand and interact with investment opportunities.

Comparison of User Experience Aspects Across Different Apps

| App Name | User Interface | Ease of Use | Support System |

|---|---|---|---|

| App A | Clean, intuitive layout with clear visual hierarchy | High; straightforward navigation and interactive elements | Responsive live chat and email support; comprehensive FAQs |

| App B | Visually appealing but somewhat cluttered | Moderate; some difficulty navigating complex investment options | Limited support channels; FAQs are less detailed |

| App C | Modern design with interactive charts and graphs | High; intuitive data visualization and quick access to information | Dedicated support team; extensive FAQs and tutorials |

Future Trends in Real Estate Investment Apps

Real estate investment apps are rapidly evolving, driven by technological advancements and changing investor needs. The future of these platforms promises increased accessibility, enhanced functionality, and potentially transformative experiences for users. This section explores the key trends shaping the landscape, from emerging technologies to predicted challenges.

Emerging Technologies Shaping the Future

Real estate investment apps are poised to integrate cutting-edge technologies. Blockchain technology, for instance, is likely to play a significant role in facilitating secure and transparent transactions, particularly in international investments. Furthermore, advancements in artificial intelligence (AI) and machine learning (ML) will likely revolutionize the way investors analyze properties and assess risk. This includes automated valuation models and personalized investment recommendations tailored to individual investor profiles.

Emerging Trends and Innovative Features

Several innovative features are expected to emerge in real estate investment apps. These include augmented reality (AR) tools that allow potential buyers to virtually tour properties, predictive analytics for market forecasting, and personalized financial planning tools integrated within the apps. The integration of virtual reality (VR) for immersive property previews is also a strong possibility. These enhancements will likely improve the user experience, allowing for more informed decision-making and streamlined investment processes.

AI and Machine Learning Influence

AI and machine learning will significantly impact real estate investment apps. AI-powered tools can analyze vast amounts of data to identify promising investment opportunities, predict market trends, and assess risk more accurately. This will translate into more precise valuations, personalized investment strategies, and reduced reliance on human judgment in some areas. For example, AI can process vast property listings to find comparable properties, and machine learning can predict future price appreciation based on historical data and current market conditions.

Potential Disruptions and Challenges

While the future of real estate investment apps is bright, potential disruptions and challenges exist. Regulatory changes related to cryptocurrency and blockchain integration could create uncertainty. Data security and privacy concerns will remain crucial as investors entrust their financial information to these platforms. Furthermore, ensuring the accuracy and reliability of AI-driven predictions will be vital. The need for skilled personnel to manage and interpret AI-generated insights will also be a challenge.

Table of Predicted Future Trends

| Trend | Description | Impact on Users | Potential Challenges |

|---|---|---|---|

| Blockchain Integration | Enhanced security and transparency in transactions, particularly for international investments. | Increased trust and confidence in the platform, reduced fraud risk, improved global accessibility. | Regulatory hurdles, potential scalability issues, and user education needed. |

| AI-Powered Investment Analysis | Automated valuation, personalized recommendations, and predictive market analysis. | More efficient investment decision-making, reduced reliance on human judgment, potentially higher returns. | Maintaining accuracy and reliability of AI predictions, ensuring transparency in algorithms, potential job displacement in certain roles. |

| AR/VR for Property Viewing | Virtual tours, 3D property models, and immersive experiences for potential buyers. | Improved property exploration, reduced travel costs and time, enhanced buyer experience. | Cost of implementation for developers, need for high-quality visuals and user-friendly interfaces. |

| Personalized Financial Planning Tools | Integration of financial planning features to support investor goals. | Improved portfolio management, tailored investment strategies, and better financial planning. | Data privacy concerns, need for accurate and reliable financial data, and user acceptance of these integrated tools. |

FAQ Compilation: Real Estate Investment Apps That Actually Work In 2025

Real Estate Investment Apps That Actually Work in 2025 – What are the key factors to consider when choosing a real estate investment app?

Consider the app’s security features, ease of use, and the types of investment opportunities it offers. User reviews and platform stability are also important.

What are some common types of real estate investment apps?

Crowdfunding platforms, property management apps, and brokerage services are common types of real estate investment apps. Each type caters to different investor needs and investment styles.

How can I protect myself from fraudulent real estate investment apps?

Thoroughly research the app’s reputation, review user feedback, and ensure the app uses strong security measures and transparent practices.

What role does AI and machine learning play in the future of these apps?

AI and machine learning could potentially enhance investment opportunities by analyzing market trends and providing personalized investment recommendations.